Monad's Async Execution

Unlocking Throughput: How Monad’s Asynchronous Execution Redefines Blockchain Efficiency

In the world of blockchain, speed and scalability often butt heads with security and decentralization. Ethereum, the reigning champ of smart contract platforms, has long wrestled with this trade-off—its conservative gas limits and sluggish finality reflect a design prioritizing robustness over raw performance. Enter Monad, a layer-1 blockchain that promises to shatter these constraints with a bold technique: asynchronous execution. By decoupling consensus from execution, Monad aims to deliver 10,000 transactions per second (TPS), 1-second block times, and gas fees so low they barely register—all while staying EVM-compatible. But how does it work, and why does it matter? Let’s dive in.

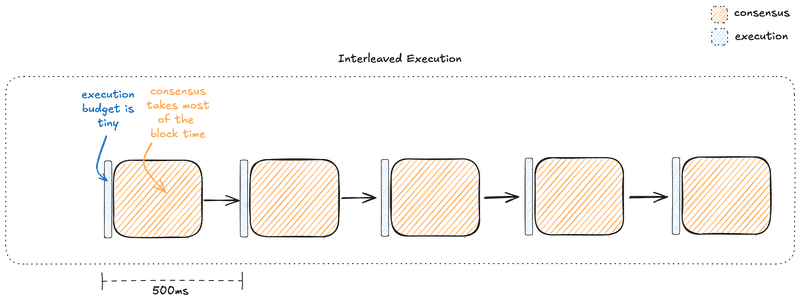

The Old Way: Ethereum’s Interleaved Execution

To understand Monad’s leap, we need to start with Ethereum’s status quo. In Ethereum’s Proof-of-Stake system, post-Merge, every 12-second slot sees a validator propose a block. That block contains two critical pieces: a list of transactions (what happened) and a state root (the result after executing them). This state root—a Merkle hash of all account balances and contract data—isn’t just decorative; it’s the cornerstone of consensus. Nodes must agree on both the order and the outcome.

Here’s where it gets inefficient. The proposing validator (the “leader”) gathers, say, 15 million gas worth of transactions—about 100 simple transfers. Before broadcasting, it executes them on the Ethereum Virtual Machine (EVM), updating the state and computing the root. This takes roughly 50 milliseconds on decent hardware. The block goes out, and then every other validator—hundreds of thousands of them—re-executes those same transactions to verify the root matches. Another 50ms. That’s 100ms total, squeezed into a 12-second slot, leaving 11.9 seconds for network latency and consensus chatter.

Why twice? Trust. The leader could lie about the state root—say, sneaking in an invalid transfer so validators re-run the math to confirm. On any single node, execution happens once, but across the network, the same transactions are processed twice: once to propose, once to validate. This double execution, interleaved with consensus, caps Ethereum’s gas limit at a conservative 30M per block (worst-case), or 1.25M gas per second. Result? A measly 20-30 TPS, and gas fees that spike to $5 or more during DeFi rushes. Execution uses just 1% of the block time—talk about a bottleneck.

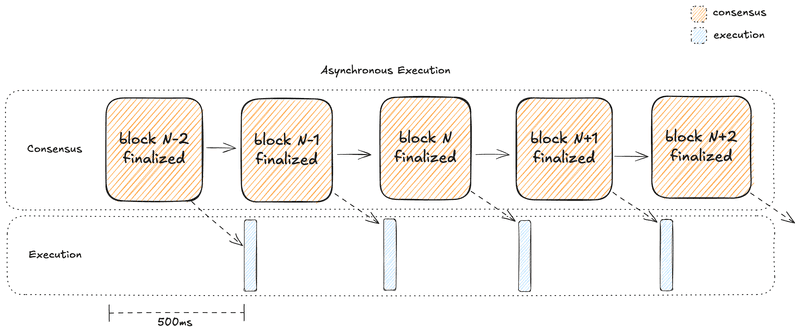

Monad’s Game-Changer: Asynchronous Execution

Monad flips this script. Instead of tying execution to consensus, it splits them into separate “swim lanes.” Consensus—agreeing on the official transaction order—runs independently, while execution lags slightly behind. Here’s how it unfolds:

The leader proposes a block with just the transaction list—no state root required. Validators check basic validity (signatures, nonce order) and vote, using MonadBFT’s 2-chain commit rule to finalize the block in two rounds, or about 2 seconds with 1-second block times. Crucially, nobody executes anything during this phase. Once finalized, all nodes—validators and full nodes alike—execute the transactions to update their local state. One run, not two, budgeted for the full 1-second block time.

This decoupling eliminates Ethereum’s redundancy. The leader doesn’t pre-execute to propose; validators don’t re-execute to vote. The network executes once, post-consensus, targeting a staggering 1 billion gas per second—800 times Ethereum’s capacity. That’s enough for 10,000 TPS, assuming 100K gas per transaction. By giving execution the entire block time, not a 100ms sliver, Monad turns a choke point into a firehose.

Why Twice Hurts, and Once Heals

Ethereum’s double execution isn’t a flaw—it’s a trust mechanism. Without validators re-running transactions, a malicious leader could fudge the state, and consensus would collapse. But this safety comes at a cost: wasted compute and a tiny execution budget. Monad sidesteps this by trusting consensus to lock the order, deferring execution to a unified step. If a transaction reverts (e.g., insufficient balance), it’s still in the block—nodes sort it out later. The result? More gas per block, processed more efficiently, without the leader-validator ping-pong.

Parallel Execution: The Turbo Boost

Monad doesn’t stop there. It pairs asynchronous execution with parallel processing. Ethereum’s EVM is single-threaded—transactions run sequentially, one after another. Monad’s engine spots independent transactions (e.g., Alice sending ETH to Bob, unrelated to a contract update) and runs them on separate threads simultaneously. With 1 billion gas split across, say, 16 cores, each handles ~62.5M gas/sec. A sequential 3-4 second job shrinks to 0.25 seconds, fitting the 1-second block time. This synergy—async freeing the full slot, parallelization maximizing it—squeezes out even more throughput.

Gas Fees: From chokehold to Cheap

So, how does this help gas fees? It’s all about supply and demand. Ethereum’s 15M gas per block is a trickle—demand (NFT mints, DeFi arbitrage) often swamps it, driving base fees sky-high via EIP-1559. A 150K-gas swap fills 1/100th of a block; during congestion, you’re paying MON terms (say, 1/MON), transactions become near-free.

Early on, with a smaller ecosystem than Ethereum’s $200B DeFi juggernaut, Monad’s supply could dwarf demand, keeping fees low. Even as adoption grows, the sheer capacity—800x Ethereum’s—means fees rise slower. Efficiency (one execution, parallelized) stretches each gas unit further, amplifying the effect.

Trade-Offs and Takeaways

This isn’t magic. Execution lagging consensus means dApps might need to adapt—state updates aren’t instant. Cramming 1B gas into 1 second demands beefier nodes (12-16 cores, 128 GB RAM), nudging decentralization toward hobbyists with deeper pockets. And Monad charges a “carriage cost” for including transactions in consensus—spam protection separate from execution gas—but details are TBD.

Still, the payoff is seismic. Ethereum’s interleaved chokehold wastes time and caps scale; Monad’s async leap unlocks a future where blockchain feels like the internet—fast, cheap, and seamless. For validators, early adopters could ride a Solana-like wave: low entry costs today, massive rewards if $MON moons. For users, it’s a shot at DeFi without the fee sting. As Monad’s testnet hums (launched February 19, 2025), the proof’s in the pudding—watch this space.